The IRS is high on the list of GOP targets — and the actions of one agent seem likely to give them more ammunition.

|

Listen To This Story

|

When the Internal Revenue Service (IRS) does its job, it is a thorn in the side of tax cheats — often wealthy Americans and corporations.

That is why one of the first things the new Republican House majority did this year was to pass legislation that would rescind $71 billion in funding for the IRS — even though the nonpartisan Congressional Budget Office projected that this move would add $114 billion to the deficit over the next decade.

GOP lawmakers justified the vote by erroneously claiming that the additional funding would be used to hire 87,000 new IRS agents. In fact, that figure refers to all employees the agency plans to hire over the next decade. While some of the new hires would be auditors, the majority would work in other areas such as customer service. And even the additional agents would only bring the number of employees back to the level of the IRS workforce of the 1990s, i.e., before Republicans started gutting the agency.

Therefore, it is fair to conclude that the IRS is high on the list of the GOP’s targets — and it looks as though one agent in Ohio just gave them some ammunition.

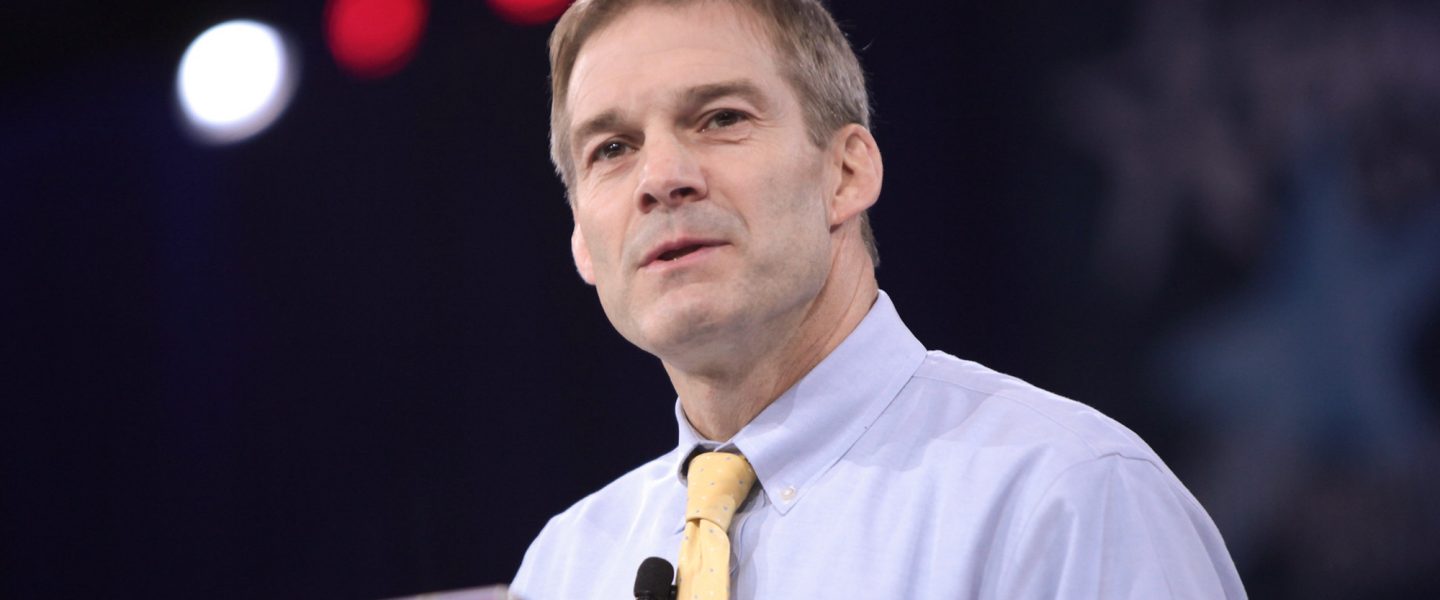

In a letter to IRS Commissioner Daniel Werfel, House Judiciary Committee Chairman Jim Jordan (R-OH) described a “bizarre” field visit in which an agent gave a false name to harass a woman in Ohio.

During that unannounced visit, the agent identified himself as “Bill Haus” and said he was with the agency’s Criminal Division and came to her home to discuss an estate for which she was the fiduciary.

At first, the woman thought this was a scam, but the agent knew details about her situation that only the IRS would know.

“Haus” then informed her that she owed the IRS “a substantial amount.” The woman then provided him with evidence that this was not the case.

“At this point, Agent ‘Haus’ revealed that the true purpose of his visit was not due to any issue with the decedent’s estate, but rather because the decedent allegedly had several delinquent tax return filings,” the letter said.

The woman then called her attorney, who asked the agent to leave her home.

“Agent ‘Haus’ responded aggressively, insisting: ‘I am an IRS agent, I can be at and go into anyone’s house at any time I want to be,’” Jordan wrote. “Before finally leaving the taxpayer’s property, Agent ‘Haus’ said he would mail paperwork to the taxpayer, and threatened that she had one week to satisfy the remaining balance or he would freeze all her assets and put a lien on her house.”

The woman then contacted her local police department to figure out whether she was the victim of an intended scam. Following an investigation, the department discovered the true identity of the agent and called him.

“Haus” then admitted to using an alias. The officer who spoke with him then informed the IRS agent that he should not go back to the woman’s home again or he would be arrested.

Instead of letting the matter rest, “Haus” then filed a complaint against that officer with the Treasury Inspector General for Tax Administration.

The woman, for her part, contacted the supervisor of “Haus,” who told her that she owed nothing and “admitted to the taxpayer that ‘things never should have gotten this far,’” Jordan wrote.

While the issue has been resolved, the lawmaker has some specific questions for IRS Commissioner Werfel.

“This behavior from an IRS agent to an American taxpayer — providing an alias, using deception to secure entry into the taxpayer’s home, and then filing an Inspector General complaint against a police officer examining that matter — is highly concerning,” Jordan wrote.

As a result, he wants Werfel to provide the committee with all documents and communications concerning that field visit.

Now, usually the actions of an individual agent would not trigger a congressional investigation — although if this were a systemic problem, it should be addressed — so why should anybody care?

That’s because chances are that you will be hearing a lot more about “Agent Haus,” who is going to become a poster child for why the IRS must be defunded.

The Wall Street Journal already wrote an editorial about him.

“What the hell is going on over there? What in IRS workplace culture gives agents the belief they can do this? Democrats bestowed $80 billion on the IRS last year to empower people like ‘Bill Haus,’” the Editorial Board of the right-leaning, business-friendly paper wrote.

Obviously, any abuse of power by an IRS agent should not be tolerated and merits an investigation. However, it is just as important that an individual case of misbehavior (if that is what this is) should not be used to denigrate an entire government agency just because Republicans don’t like it when rich people have to pay taxes.