How to Stop Funding the Climate Crisis

Chances are your credit card, retirement plan, or even your savings account are linked to fossil fuels.

|

Listen To This Story

|

There’s a good chance that the money you have sitting in the bank generates more carbon than anything else you do.

According to the activist Bill McKibben, who analyzed a 2021 report on fossil-fuel finance, “It works out that $62,500 in one of the big American banks could produce as much carbon (about 8 tons) as all the heating, driving, flying, cooling and cooking an average American does in six months.”

Nearly a quarter of all funds in Wall Street’s six major banks — Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley, and Wells Fargo — touch “high-carbon activities in some way, shape or form,” according to Allison Fajans-Turner, managing director of BankFWD, a climate advocacy group.

The world’s 60 biggest banks have invested more than $5.5 trillion in fossil fuels since the Paris Climate Accord in 2016, according to Banking on Climate Chaos, an annual report published by the Rainforest Action Network and other civil society groups.

That’s why climate activists are increasingly turning their attention to big banks as part of their efforts to prevent more carbon from entering the atmosphere. “We wouldn’t have things like the Willow Project or Line Three” — an oil drilling project in Alaska and a pipeline from Canada to Wisconsin, respectively — “if we didn’t have these big banks underwriting them by lending them all this money,” said Cathy Becker, responsible finance campaign director for Green America, a nonprofit.

If the climate emergency isn’t motivation enough to stop investing in fossil fuels, consider the bottom line. “Multiple studies show that returns on sustainable/fossil-free investing are generally not worse and often slightly better than market averages, especially over the long run,” Becker said.

There are relatively simple ways you can move your finances away from fossil fuels. Nexus Media News spoke with several advocates and financial experts about how to decarbonize your money. Here’s what they said:

1. Cut up your credit card.

“The easiest thing that people can do that makes a difference is to close their credit card,” said Vanessa Arcara, president of Third Act, a climate group she founded with McKibben that mobilizes Americans over 60. In March, the group organized a day of action, in which protesters marched in front of branches of the nation’s four largest banks and cut up their credit cards.

“Banks spend about $1,000 per credit card holder to market to and retain that person as a customer, so it’s a huge revenue stream they really care about,” Arcara said. Americans paid about $133 billion in credit card interest and fees in 2022, according to Lending Tree.

Third Act has compiled a list of resources for customers looking to switch their credit cards; Green America, another advocacy group, issues its own credit card and offers a list of other responsible cards.

You might lose some perks — although some airlines let you retain miles earned through cards even after you close your account — and sites like Nerd Wallet recommend using up your points before closing your account. But, Arcara said, “An increasing number of non-fossil invested credit cards do also offer cash back at often-competitive rates.”

2. Quit your bank — or at least threaten to.

“Moving your money to community banks or community development financial institutions is an overlooked climate solution,” said Fajans-Turner of Bank FWD. “They have much lower levels of fossil fuel exposure.”

Green America offers a 10-step guide to breaking up with your bank. Bank.Green can help you examine your banks’ fossil fuel investments and offers localized recommendations of banks that do not invest in fossil fuels. Experts also recommended New York’s Amalgamated Bank and Beneficial Bank, founded by former philanthropist and former presidential candidate Tom Steyer.

If you’re wary of leaving your bank in one fell swoop, Fajans-Turner suggested starting a “protest account” in a non-fossil fuel investing bank and moving your money over gradually.

“That might look like writing to your bank and saying, ‘I am disappointed in your climate policies. I am starting the process of moving my money. But ultimately, I don’t want to have to move my money and you can keep my business if you make progress towards x, y and z metrics,’” Fajans-Turner said. “Publicize it to your existing bank and make that public on your own social channels as well.”

3. Move your retirement funds and other investments if you have them.

“After their homes, retirement plans tend to be people’s largest asset,” said Timothy Yee, co-founder of Green Retirement, a financial services firm. Americans hold $11 trillion in private retirement investments, such as employer-offered 401(k)s, according to the investment firm Vanguard. Most of that money is held in index funds, meaning consumers don’t always know what investments they hold.

Yee uses sites like Fossil Free funds.org, which scores investment plans based on factors such as deforestation and holdings in coal, to show clients “where their money sleeps.”

Pointing to one popular fund with investments in fossil fuels and private prisons, Yee said, “Most people would look at that report card and say, ‘Gosh, that’s not who I am. It’s not who I am in my personal investments and it’s not who I want to be through my company plan.”

If, like 100 million Americans, your retirement plan is issued by your employers, you may need to push your human resources department to offer fossil-fuel-free options, said Cathy Becker of Green America.

“See if you can find like-minded employees at your workplace who also want this kind of sustainable or fossil-free investing — it helps to have more than one person’s voice,” she said. As You Sow, a site that helps users identify low-carbon funds, offers a tool that allows employees of large US companies to look up their retirement plans’ fossil fuel investments. It also offers a guide to approaching employers about offering greener options.

There is some debate about whether it’s better to engage with institutions about improving their practices before divesting. Andy Behar, CEO of As You Sow, says one downside of divestment is that you can no longer push for change from within, by casting votes through proxies at annual shareholder meetings. (In recent years activist investors have waged proxy battles, with little success, to push oil companies like Exxon Mobil to adopt more climate-friendly practices.) When it comes to investment accounts, “If you sell your shares, you won’t be able to vote your proxies, you’re no longer a seat at the table,” Behar said.

Of course, he added, some people can’t sleep at night knowing they’re funding Big Oil and prefer simply to divest. “It’s a personal decision,” he said. “What’s important to us is that you understand your values, and that you align your money and your banking investing with those values.”

4. Organize.

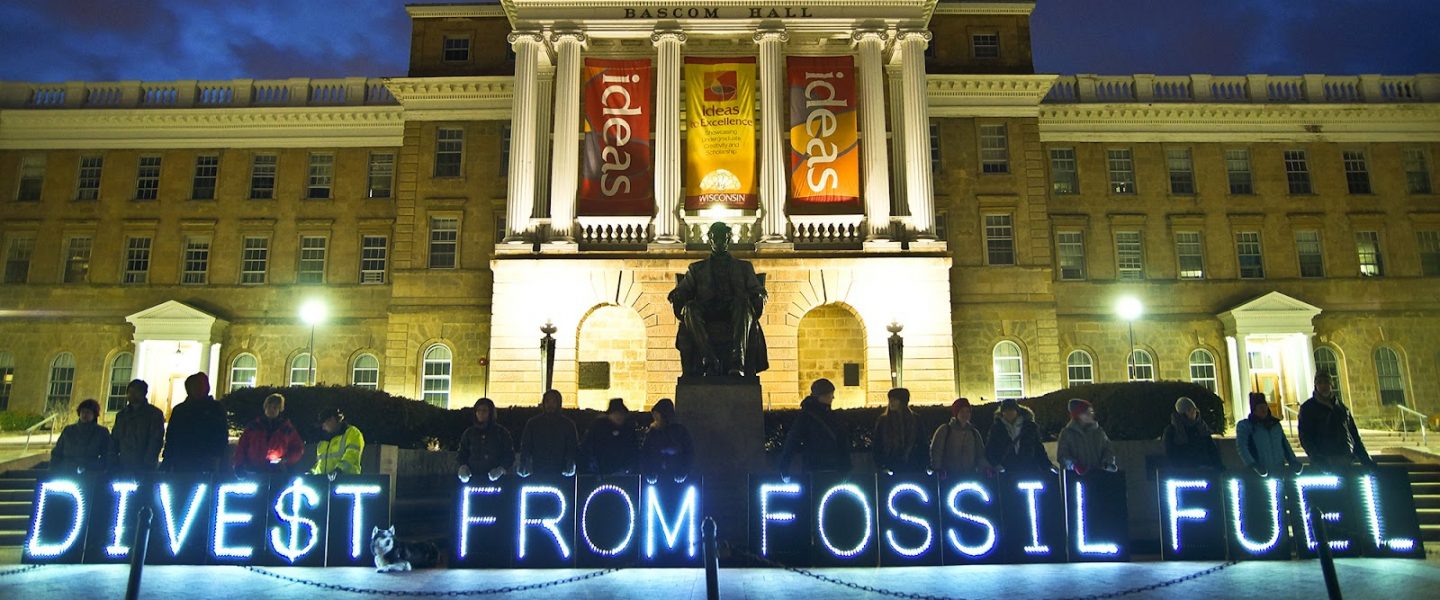

Some of the most successful efforts to get money out of fossil fuels have been university divestment campaigns. Student activists at Harvard University, Boston University, and the University of Minnesota, among other schools, have successfully campaigned for their schools to stop investing in fossil fuels. Similarly, activist investors have become a thorn in the side of Big Oil companies, passing resolutions urging them to act on climate change.

Third Act draws its power from the economic heft of its members. “I always find it useful to remind people that folks over the age of 60 in the United States hold more than 70% of the nation’s wealth,” said Arcara. Her organization is betting that if enough seniors organize against fossil fuels they can change the Big Banks’ investing practices.

“It always comes down to collective action,” said Arcara.

This story by Danielle Renwick was originally published by Nexus Media News and is part of Covering Climate Now, a global journalism collaboration strengthening coverage of the climate story.