Timothy Mellon and the Political Peril of Dynastic Wealth

Like his forebears (and like Donald Trump), Mellon rages only against those handouts that go to those born without silver spoons.

|

Listen To This Story

|

If Donald Trump takes power this November, he’ll owe his victory in no small part to one of the richest Americans alive — in 1920.

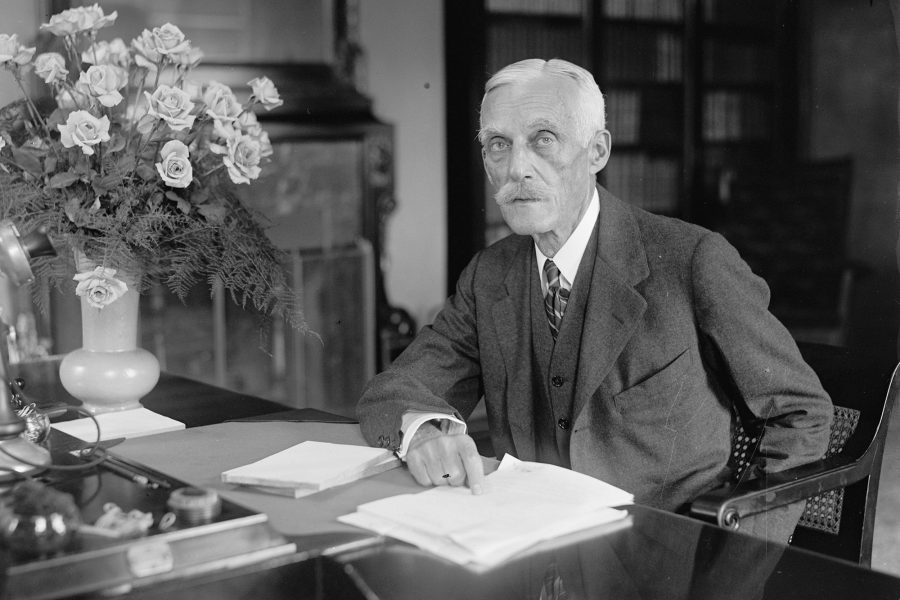

I’m talking about the Pittsburgh banker and industrialist Andrew Mellon, who as treasury secretary for Warren G. Harding, Calvin Coolidge, and Herbert Hoover changed the US tax code in ways that allowed — more than a century later — part of his personal fortune to bankroll Trump’s reelection campaign.

Andrew’s grandson, Timothy, has so far contributed $20 million to Trump’s MAGA Inc. super PAC.

Since 2018, Timothy Mellon has also donated $30 million to the House Republicans’ super PAC for electing Republicans to the House. In 2020, he gave $30 million to the Senate Republicans’ super PAC.

Timothy has so far donated $15 million to Robert F. Kennedy Jr.’s super PAC — showing just how important Kennedy’s candidacy is to Trump’s strategy of siphoning votes from Biden.

Timothy is also responsible for nearly all the donations to Texas Governor Greg Abbott’s $54 million border wall fund.

Forbes estimated Timothy Mellon to be worth almost $1 billion in 2014, and in 2024 the magazine estimated the Mellon family was worth $14.1 billion. But Timothy didn’t earn his money. He inherited it. The money trail spans four generations.

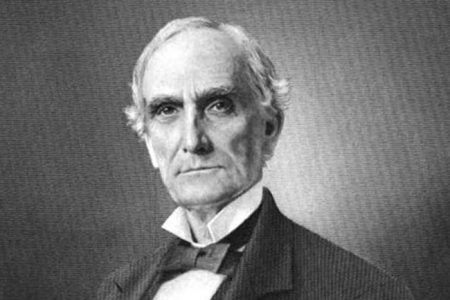

It began with Thomas Mellon, who started his own bank in Pittsburgh in 1869. Thomas’s bank attracted the deposits of robber barons like Andrew Carnegie and Henry Frick, and within a relatively short time it became the largest private bank between New York and Chicago.

Steeped in social Darwinism, Thomas Mellon promoted suicide as decency: If criminals were sufficiently public‐spirited, he argued, they would “manfully rid the world of their presence, and society of the expense and trouble of their trial and punishment.”

Thomas viewed the acquisition of wealth as a mark of merit, and poverty as a failure of character. Thomas wrote in his autobiography that voting rights were responsible for many of society’s ills, driving higher spending, borrowing, and taxes.

After the Civil War, Thomas toured the South, where he was disgusted to see Louisiana’s Legislature captured by what he called “stolid, stupid, rude and awkward field negroes, lolling on the seats or crunching peanuts.” He wrote that these representatives were puppets of white Northerners who were using “corrupt schemes to rob the property owners and taxpayers.”

Thomas brought his two sons, Andrew and Richard, into the banking business. Then, in partnership with Henry Frick, Andrew and Richard organized a new bank — the Union Trust Company — which became even more successful.

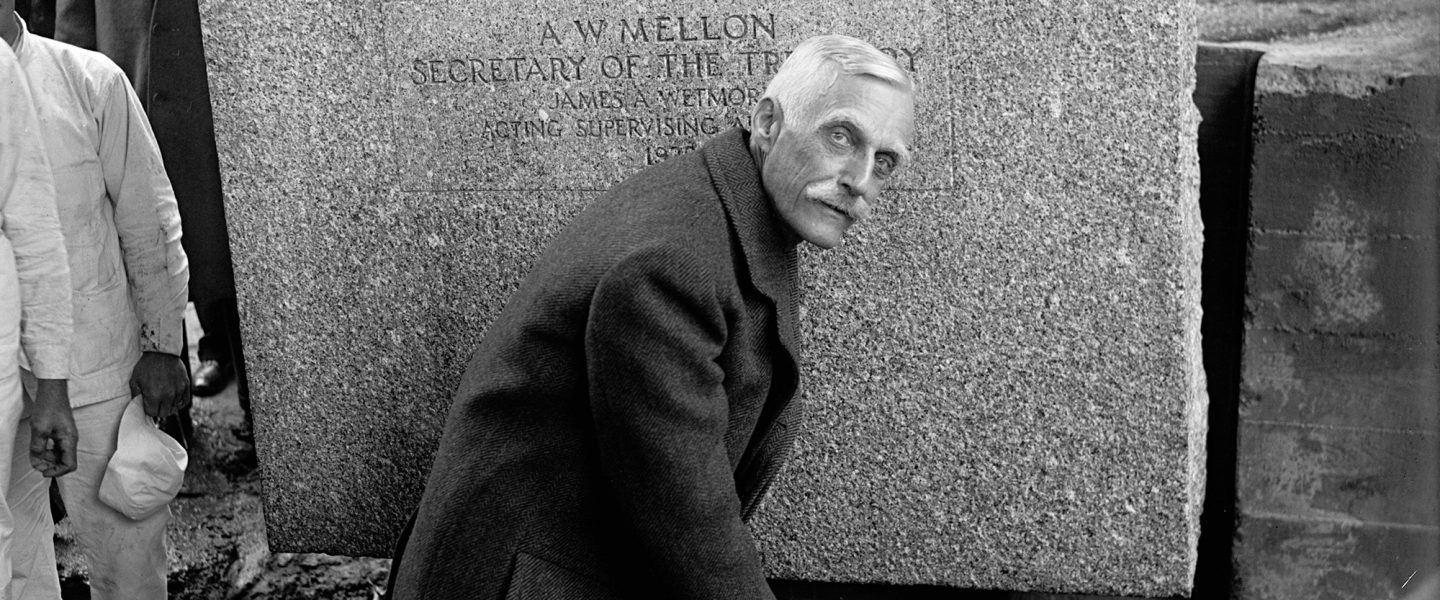

Andrew knew how to use his wealth for political advantage. He supplied such a large portion of the campaign dollars that helped Warren G. Harding become president in 1920 that Harding made Andrew secretary of the treasury.

Andrew held the position for the next 11 years, from 1921 to 1932 — longer than anyone in the history of the country (or as Nebraska Sen. George Norris once acidly put it, “three presidents served under Mellon”).

Andrew was intent on cutting taxes. He was an early prophet of “trickle-down” economics, arguing that lowering taxes on companies and the wealthiest would spur investment that would lead to prosperity for the nation. “Taxes which are inherently excessive are not paid,” Andrew wrote in a book on taxation published while he was treasury secretary.

Andrew especially hated the estate tax. “The social necessity for breaking up large fortunes in this country does not exist,” he wrote. Andrew ended up cutting the estate tax by half. He also whittled down the top income tax rate from 73 percent to 25 percent and eliminated the gift tax.

These changes enabled Andrew to shift much of his personal fortune — estimated to be $600 million, or about $9 billion today — tax-free to his heirs.

Andrew was still treasury secretary when the Great Depression hit, ending his public career in disgrace.

Franklin D. Roosevelt’s New Deal turned Andrew’s tax policies upside down. Under FDR, whom one biographer hailed as a “traitor to his class,” the top income tax rates went as high as 94 percent to raise funds for World War II. The tax on the largest estates rose to 77 percent.

But the Mellon fortune survived notwithstanding. In 1957, Fortune magazine ranked four Mellon heirs among America’s eight richest individuals.

Paul Mellon, Timothy’s father and the scion of Mellon Generation #2, is best remembered as a philanthropist and breeder of horses. As he wrote in his autobiography, aptly titled Reflections in a Silver Spoon, “I have been an amateur in every phase of my life … and I can honestly say that I’ve thoroughly enjoyed all the roles I have played.”

Thence came Timothy Mellon — the fourth generation, and the Trump reelection campaign’s top benefactor.

Like his forebears (and like Donald Trump), Timothy Mellon rages only against those handouts that go to those born without silver spoons. In his self-published 2015 autobiography, Timothy argued that expanded social programs have only made Black people “even more belligerent”:

For delivering their votes in the Federal Elections, they are awarded with yet more and more freebies: food stamps, cell phones, WIC payments, Obamacare, and on, and on, and on. The largess is funded by the hardworking folks, fewer and fewer in number, who are too honest or too proud to allow themselves to sink into this morass.

Timothy Mellon — and the tens of millions he is shelling out to Trump, RFK Jr., and Republican candidates for the Senate and House — is the product of a tax system pioneered by his grandfather that allows the perpetuation of dynastic wealth and the maintenance of its political power.

The Mellon money trail exemplifies the perils of dynastic wealth — and why we need a wealth tax in America. Or the capital gains tax must be applied to the appreciated value of assets held during someone’s life, before they die and hand them off to their heirs at current market value.

When he was a Virginia legislator, Thomas Jefferson sought legal ways to prevent the perpetuation of great fortunes, fearing the rise of an American “aristocracy of wealth,” which, Jefferson believed, posed more “harm and danger, than benefit, to society.”

The wealth and power extending from Thomas to Andrew to Paul to Timothy Mellon proves Jefferson exactly right.

Reprinted with permission from Robert Reich’s substack.

Robert B. Reich is the Carmel P. Friesen Professor of Public Policy at the Goldman School of Public Policy at the University of California, Berkeley. He has served in three national administrations, including as secretary of labor under President Bill Clinton. He has written eighteen books, including the bestsellers The System: Who Rigged It, How We Fix It; The Common Good; Saving Capitalism; Aftershock; Supercapitalism; and The Work of Nations.